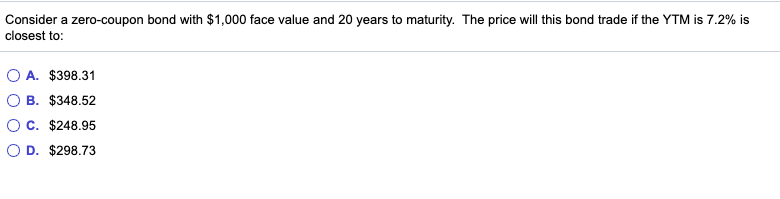

44 consider a zero coupon bond with 20 years to maturity

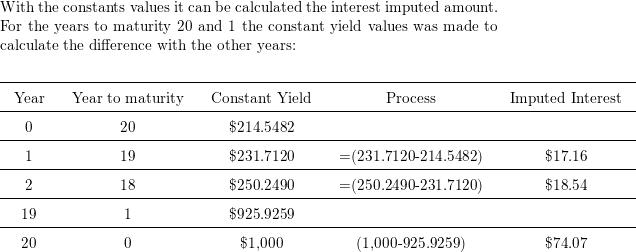

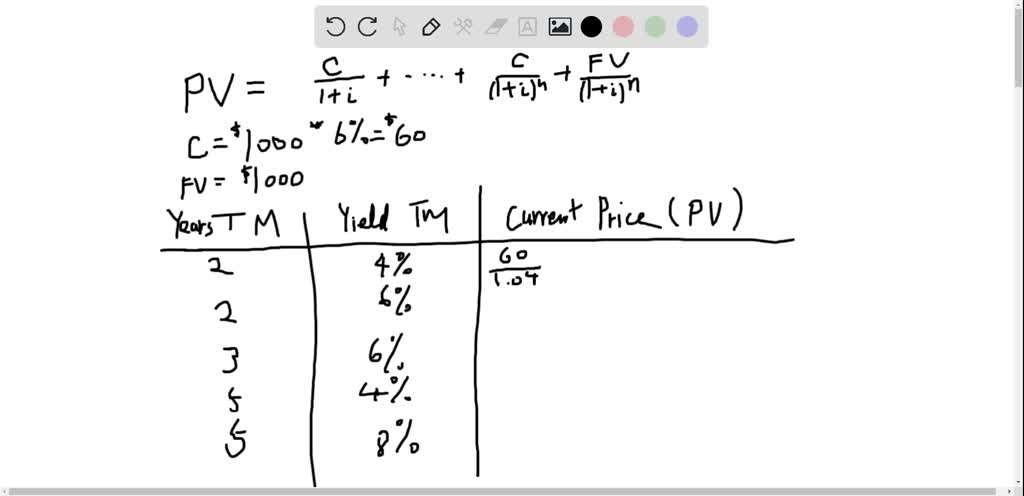

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ... Financial Management Exam 3 Flashcards | Quizlet Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is. $311.80. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is. 371.80.

Consider a zero coupon bond with 20 years to maturity consider the following four bonds that pay annual coupons: bond years to maturity coupon ytm a 1 0% 5% b 5 6% 7% c 10 10% 9% d 20 0% 8% 19) the percentage change in the price of the bond "a" if its yield to maturity increases from 5% to 6% is closest to: a) -4% b) -6% c) -1% d) 4% answer: explanation: c) bon d years to maturit y coupo n ytm price …

Consider a zero coupon bond with 20 years to maturity

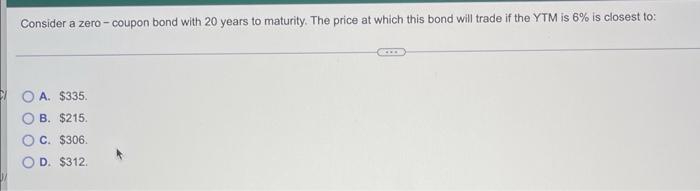

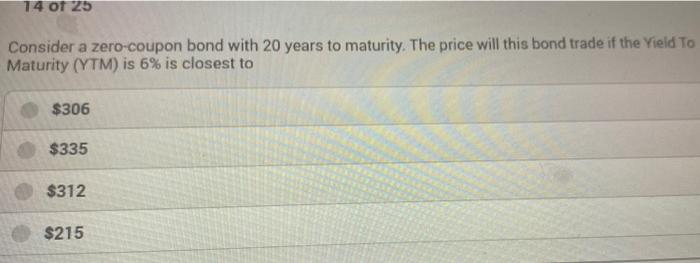

Consider a zero coupon bond with 20 years to maturity Consider a zero-coupon bond with 20 years to maturity. The price will this bond trade if theYTM is 6% is closest to ________________. Hint: Assume par value is $1000, annual compounding. A. $215B. $312C. $335D. $306 2 . $ 312 Ch 5FIND THE YIELD TO MATURITYOF A ZERO-COUPON BOND14. Consider a zero coupon bond with 20 years to maturity See Page 1 15) Consider a zero-coupon bond with 20 years to maturity. The amount that the price of thebond will change if its yield to maturity decreases from 7% to 5% is closest to: A) $118. B) -$53. C) $53.D) $673. Answer: Explanation:Following the prior logic, let's first price the zero-coupon bond at 7%. P= $1,000 1+7%20= $258.42 Now at 5%:A Question : Consider a zero coupon bond with 20 years to maturity. : 161993 Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to: Question 17 options: A) 38% B) 17% C) 22% D) 46% Solution 5 (1 Ratings ) Solved Database1 Year Ago73 Views This Question has Been Answered! View Solution Related Answers

Consider a zero coupon bond with 20 years to maturity. Consider a zero coupon bond with 20 years to maturity Consider a zero-coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to ________________. Hint: Assume par value is $1000, annual compounding. A. $215 B. $312 C. $335 D. $306 2 . $ 312 14. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. Question 21 consider a zero coupon bond with 20 years - Course Hero QUESTION 21 Consider a zero-coupon bond with 20 years to maturity. The price this bond will trade at ifthe YTM is 6% is closest to: $215 $312 $335 $306 Bond value 1000 1+0.06^20 Bond value 1000 3.207135472 Bond value $ 312 QUESTION 22 An investor purchases a 30-year, zero-coupon bond with a face value of $1000 and a yield to maturity of 6.5%. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

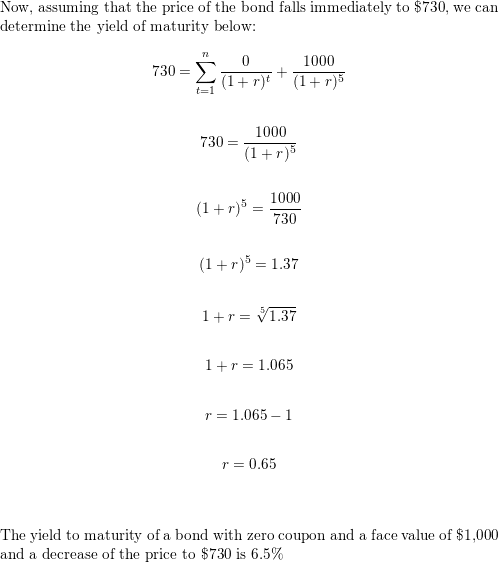

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions As the name suggests, these are bonds that pay no coupon or interest. Instead of getting an interest payment, you buy the bond at a discount from the face value of the bond, and you are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. 6.2.2 Flashcards | Quizlet Consider a zero-coupon bond with a $1000 face value and 15 years left until maturity. If the bond is currently trading for $431 , then the yield to maturity on this bond is closest to ________. A) 2.89% B) 56.90 % C) 43.10% D) 5.77% D) FV = 1000 PV = -431 PMT = 0N = 15Compute I = 5.7714 %.

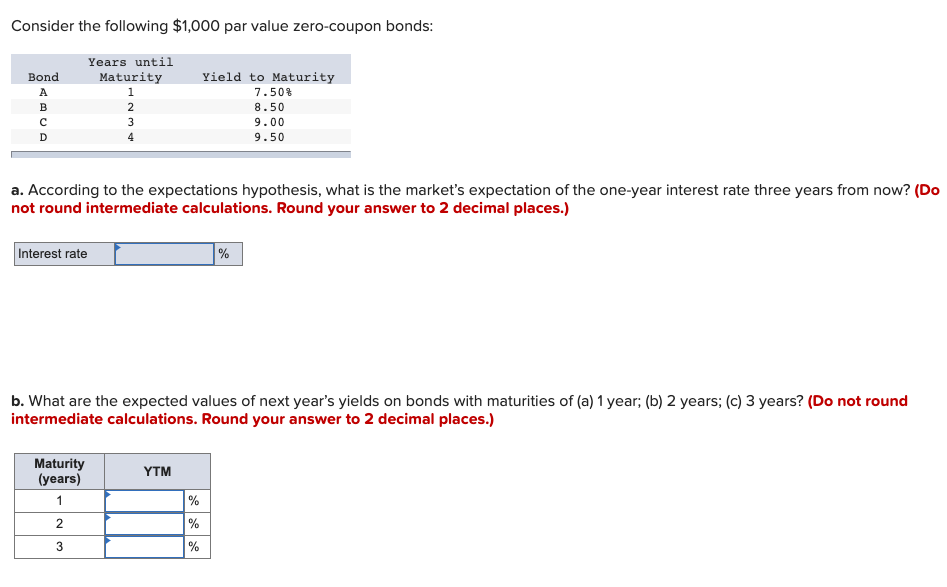

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond ... Consider the following $1,000 par value zero-coupon bonds: Bond YTM Price A 1 $909.90 B 2 $811.62 C 3 $711.78 ... a 15-year zero-coupon bond that has a par value of $1,000, Question : Consider a zero coupon bond with 20 years to maturity. : 161993 Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to: Question 17 options: A) 38% B) 17% C) 22% D) 46% Solution 5 (1 Ratings ) Solved Database1 Year Ago73 Views This Question has Been Answered! View Solution Related Answers Consider a zero coupon bond with 20 years to maturity See Page 1 15) Consider a zero-coupon bond with 20 years to maturity. The amount that the price of thebond will change if its yield to maturity decreases from 7% to 5% is closest to: A) $118. B) -$53. C) $53.D) $673. Answer: Explanation:Following the prior logic, let's first price the zero-coupon bond at 7%. P= $1,000 1+7%20= $258.42 Now at 5%:A Consider a zero coupon bond with 20 years to maturity Consider a zero-coupon bond with 20 years to maturity. The price will this bond trade if theYTM is 6% is closest to ________________. Hint: Assume par value is $1000, annual compounding. A. $215B. $312C. $335D. $306 2 . $ 312 Ch 5FIND THE YIELD TO MATURITYOF A ZERO-COUPON BOND14.

Post a Comment for "44 consider a zero coupon bond with 20 years to maturity"