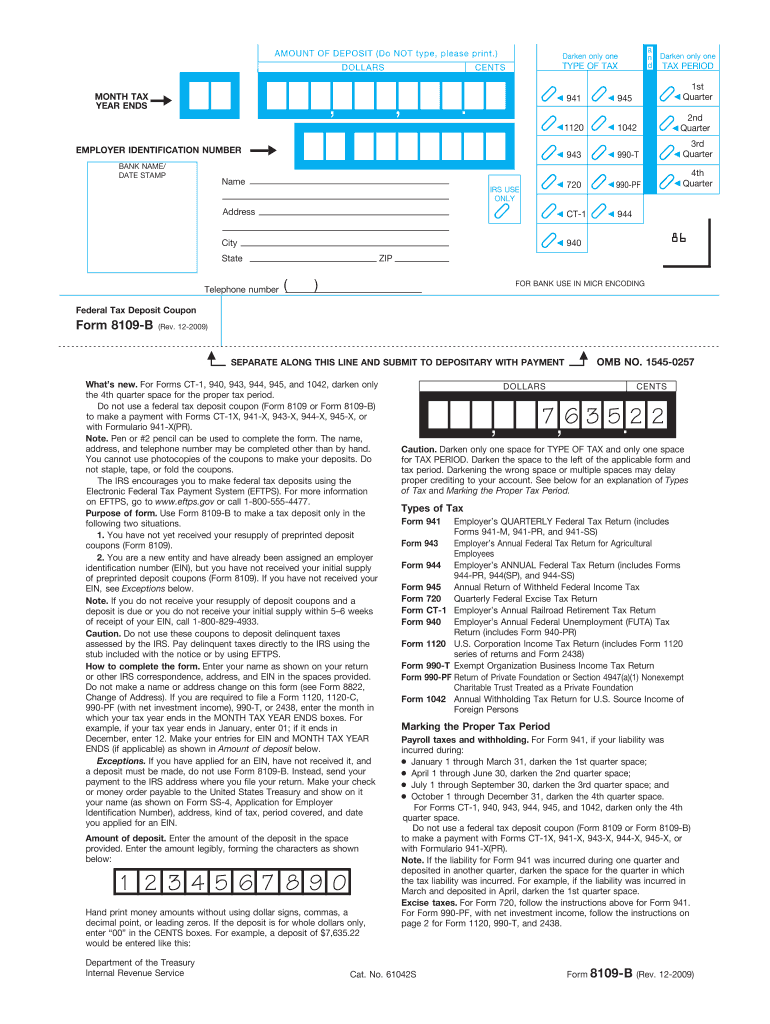

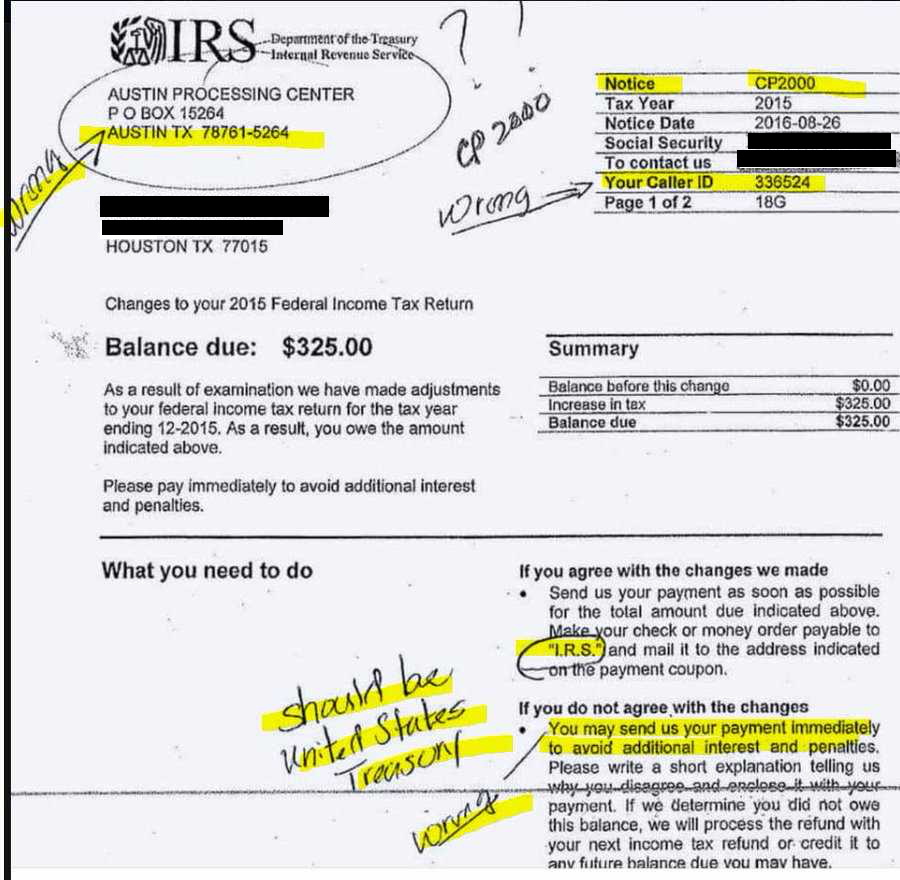

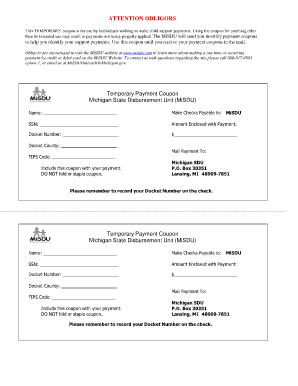

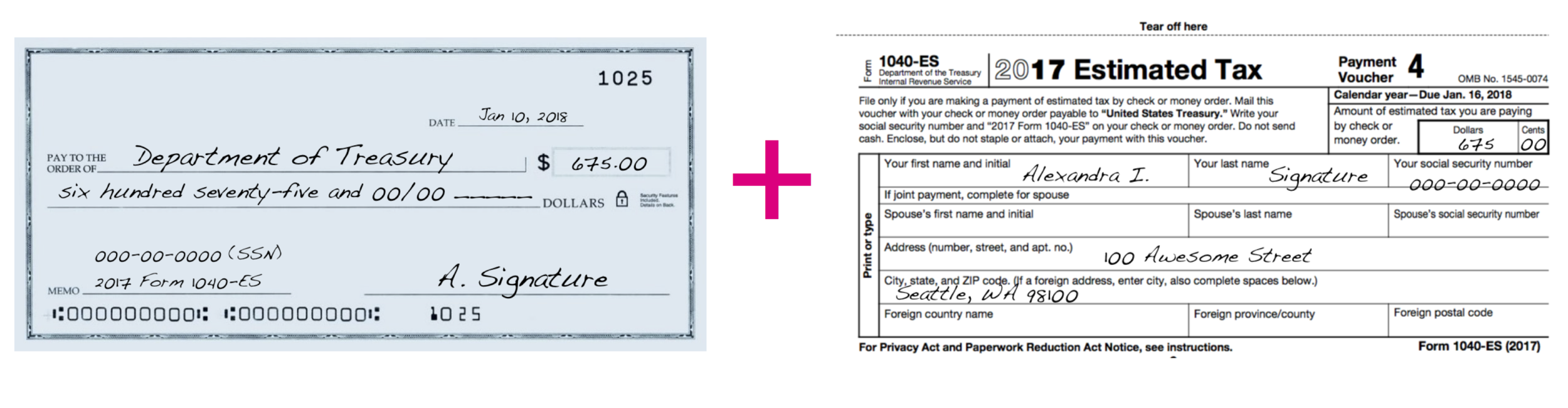

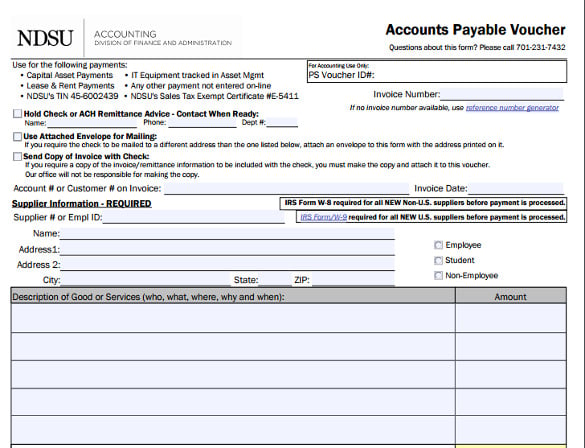

42 payment coupon for irs

consumer.ftc.gov › consumer-alerts › 2015It’s the IRS calling…or is it? | Consumer Advice Mar 12, 2015 · The IRS won’t call out of the blue to ask for payment. IRS staff won’t demand a specific form of payment, and won’t leave a message threatening to sue you if you don’t pay right away. If you get a fake IRS call, report the call to the FTC and to TIGTA – include the phone number it came from, along with any details you have. › instructions › i1099intInstructions for Forms 1099-INT and 1099-OID (01/2022) Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ...

› tax-center › irsIt's Been A Few Years Since I Filed A Tax Return. Should I ... The IRS charges (or, “assesses”) a steep penalty for filing late. Add that to the penalty for paying late, and you’re adding as much as 25% to your tax bill. But if you file the returns and get into a payment agreement with the IRS (like a monthly payment plan or other arrangement), you’ll get reduced penalties

Payment coupon for irs

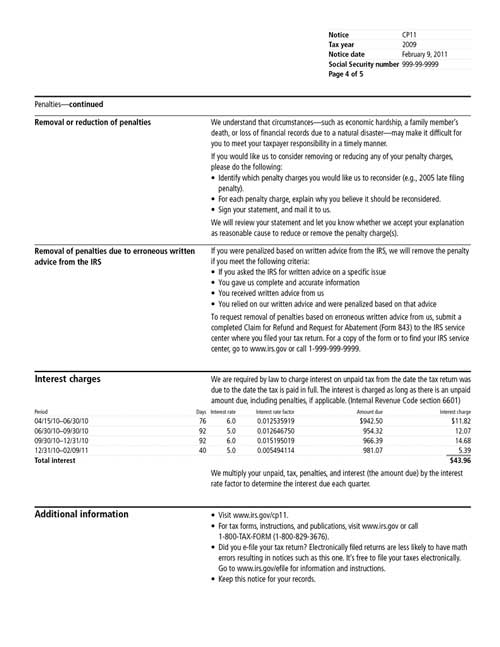

› tax-center › irsThree Ways to Reduce or Remove IRS Interest from Your Tax ... That’s why it’s critical to get into a payment agreement with the IRS: As your balance grows, so does the interest. So, it’s no surprise that people in this situation often ask the IRS to remove or reduce their interest. The IRS won’t remove interest most of the time – but if you’re proactive, you can minimize interest on your own. turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 16, 2021 · Fees for IRS installment plans. If you can pay off your balance within 120 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person. › filing › free-file-do-your-federalIRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you.

Payment coupon for irs. › payments › penalty-relief-due-to-firstPenalty Relief due to First Time Abate or Other ... Aug 24, 2022 · Required to be shown on a return, but was not, and that tax was not paid by the date stated in the notice or demand for payment under IRC 6651(a)(3) Failure to Deposit – when the tax Was not deposited in the correct amount, within the prescribed time period, and/or in the required manner – IRC 6656 › filing › free-file-do-your-federalIRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 16, 2021 · Fees for IRS installment plans. If you can pay off your balance within 120 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person. › tax-center › irsThree Ways to Reduce or Remove IRS Interest from Your Tax ... That’s why it’s critical to get into a payment agreement with the IRS: As your balance grows, so does the interest. So, it’s no surprise that people in this situation often ask the IRS to remove or reduce their interest. The IRS won’t remove interest most of the time – but if you’re proactive, you can minimize interest on your own.

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "42 payment coupon for irs"