38 ytm and coupon rate

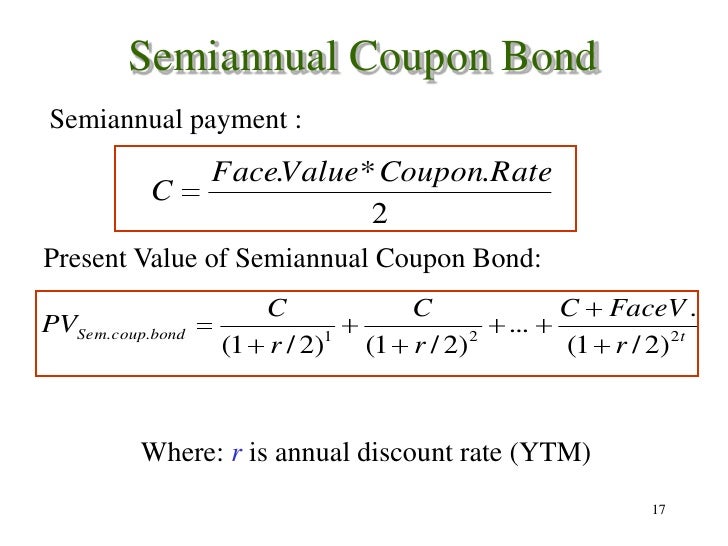

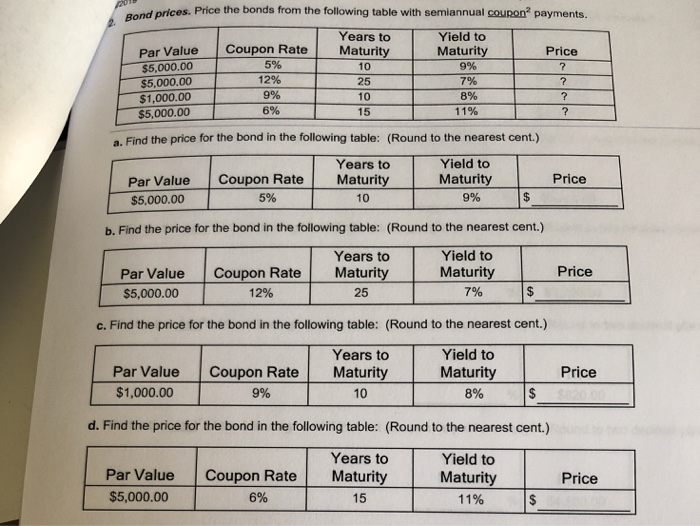

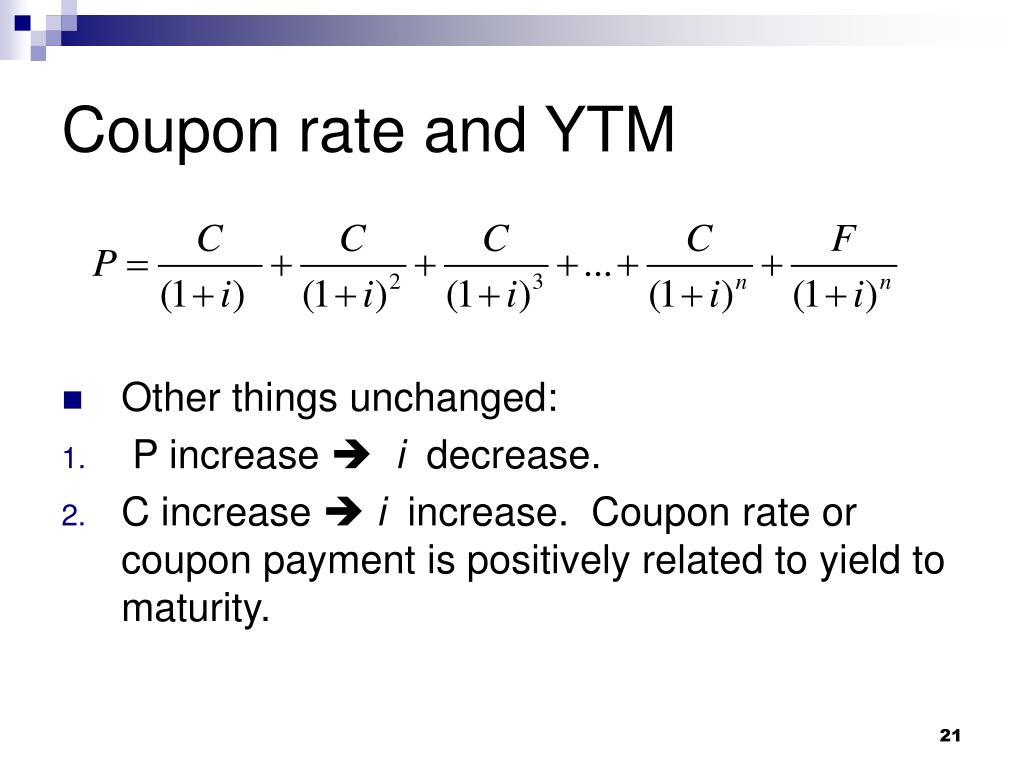

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Difference between YTM and Coupon Rates The formula for calculating YTM is as follows: YTM = [ (C/P) (1/n)]- [ (1+ (C/P))^ (-nYTM)] in which C equals annual coupon payments, P equals the price of the bond, n equals a number of compounding periods per year, and t equals a number of years until maturity.

What are interest rates, coupon rates, yield and YTM -- and how to use ... New bonds will also be issued at lower coupon rates. ... Yield to Maturity. In the above example, when the buyer of your bond (let's name her Charu ) buys it, she looks at a concept called 'Yield to Maturity' (YTM). YTM is the total return anticipated on a bond if the bond is held until it matures. The face value of the bond, in our ...

Ytm and coupon rate

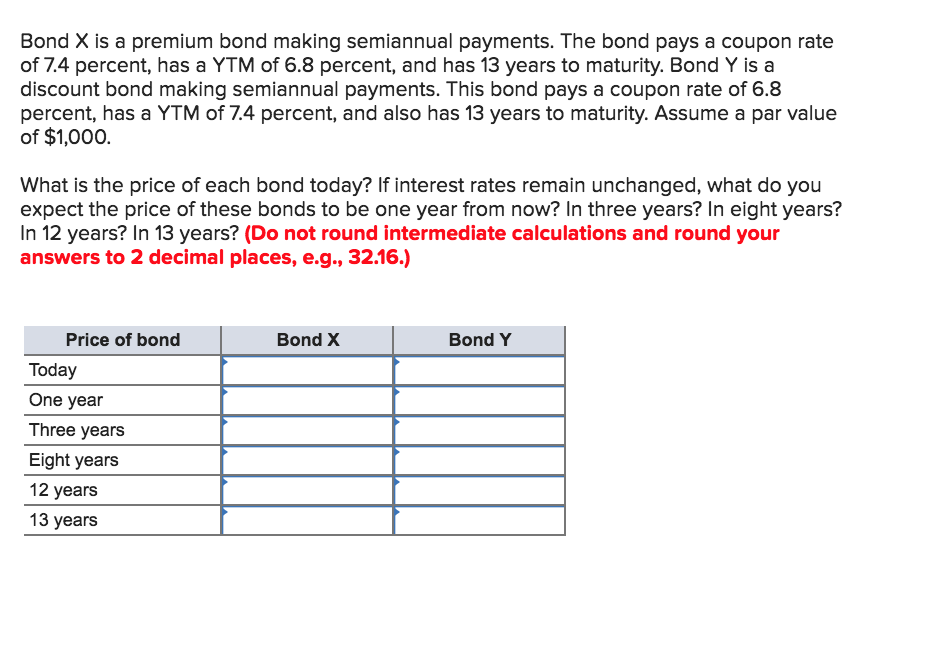

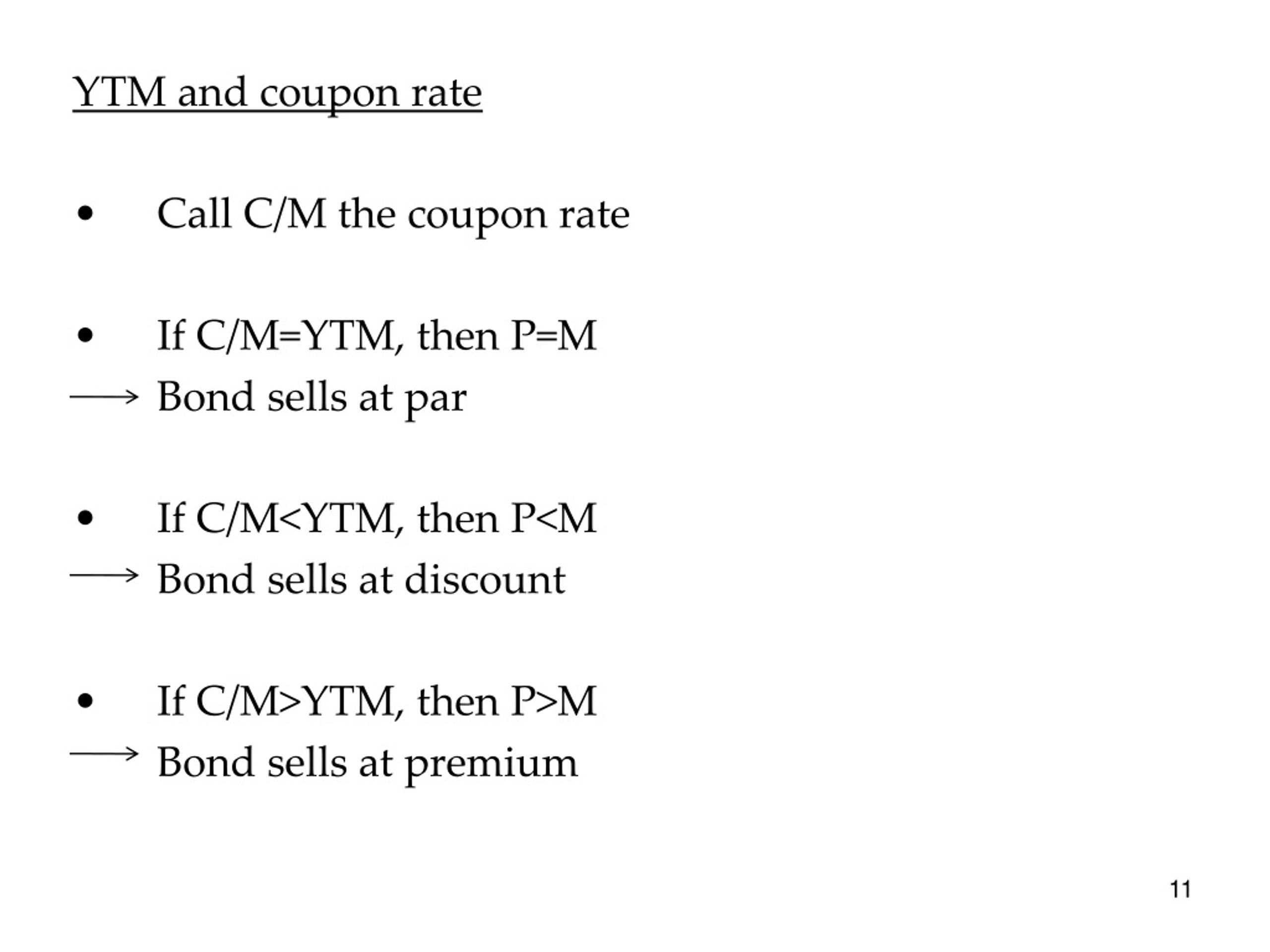

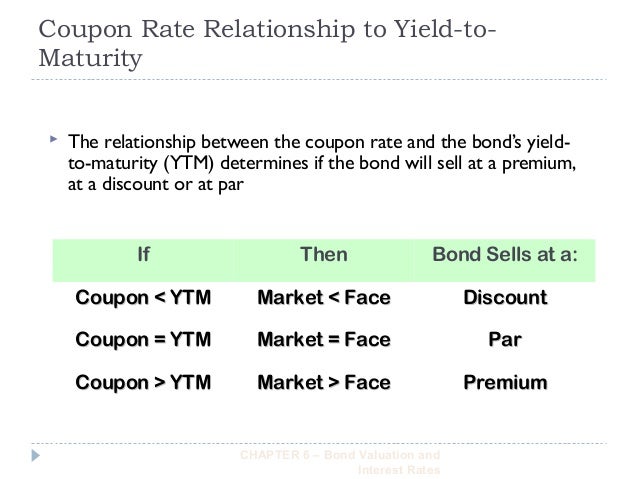

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

Ytm and coupon rate. Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww Here YTM will be higher than the coupon rate, which is 8%. If the bond is selling for a higher price than the face value, this means the interest rate in the market is lower than the coupon rate. This indicates that the YTM is lesser than the coupon rate. Current Yield Calculating Cost of Debt: YTM and Debt-Rating Approach The YTM will be the rate at which the present value of all cash flows = $1,050. $$\$1,050 = \left ( \sum_ {t=1}^ {20} \frac {\$40} { (1+i)^ {t}} \right)+\frac {\$1000} { (1+i)^ {20}}$$ We can use a financial calculator to solve for i. In this case, i = 3.643%, which is the six-month yield. The annualized yield will be 7.286%. YTM and Coupon Rate - Free ACCA & CIMA online courses from OpenTuition a bond has an bid yield of 6.2%. the coupon is 5%, maturity is 4 years. redemption is at 10% premium. so, the MV can be computed which is 103.72. my question: rule: if YTM > Coupon then MV < Par. but in this case it is not so. can you pls explain y? thank u

Yield to Maturity Formula - Crunch Numbers Difference between YTM and the Coupon Rate . A coupon rate is an interest paid to the bondholder who receives it every year from the bond's issue date until it matures. YTM > Coupon Rate; The current YTM rate is higher than the bond coupon rate ⇒ the bond is selling at a discount. Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Yield to Maturity (YTM): Formula and Excel Calculator - Wall Street Prep An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

Ytm and coupon rate 全包讲义 session 8 page 6 8 topic 10 2. The Coupon rate of a Woolworths bond is 6%. The YTM required by a buyer is 6.25%. Suddenly, the official cash rate decreases by 0.5%. What will happen to the price of the bond and will the bond be trading at a premium or discount? A. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Yield to Maturity (YTM) is the expected return on a bond if held till maturity. Learn how to calculate YTM, its importance with Scripbox. Search ... the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1 ...

Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ...

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail.

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver.

Yield to Maturity (YTM) Definition - Investopedia The main difference between the YTM of a bond and its coupon rate is that the coupon rate is fixed whereas the YTM fluctuates over time. The coupon rate is contractually fixed, whereas the YTM...

Yield to Maturity (YTM) Definition & Example | InvestingAnswers Yield to maturity refers to the return (or yield) that an investor will earn from their investment, which is typically reported as an annual rate. The return is comprised of interest payments (referred to as coupons) and any gain in the bond's market value. The yield is based on the coupon rate the bondissuer agrees to pay.

Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

Yield to Maturity (YTM) - Definition, Formula, Calculations The annual coupon rate is 8%, with a maturity of 12 years. Based on this information, you are required to calculate the approximate yield to maturity. Solution: Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80.

What is the relationship between YTM and the discount rate of a bond? Answer (1 of 3): They can be considered part of the same thing and depends on the type of bond. Yield to maturity is a concept for fixed rate bonds and is the internal rate of return i.e. the rate at which future flows are discounted on a compound basis to give the present value of the bond incl...

Difference Between YTM and Coupon rates | Investing Post 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Search DifferenceBetween.net :

Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

Post a Comment for "38 ytm and coupon rate"