38 coupon rate 10 year treasury

ycharts.com › indicators › 10_year_treasury_rate10 Year Treasury Rate - YCharts Aug 22, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ... PDF 11.250% Prospectus for Re-opened Ten-year and Fifteen-year Fixed Coupon ... 11.250% PROSPECTUS FOR RE-OPENED TEN-YEAR AND FIFTEEN-YEAR FIXED COUPON TREASURY BONDS FXD1/2022/010 AND FXD1/2022/015 13.000% TOTAL VALUE : KSHS 50 BILLION. ... or coupon rate whichever is higher, upon written . confirmation to do so from the Nairobi Securities . Exchange. Liquidity

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing August 8th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today.

Coupon rate 10 year treasury

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present TNC Treasury Yield Curve On-the-Run Par Yields, Monthly Average: 1986-Present ... Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

Coupon rate 10 year treasury. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. How Is the Interest Rate on a Treasury Bond Determined? 21.08.2022 · As of early August 19, 2022, the rate for a 10-year T-Bond was hovering around 2.98%. That is a lower typical rate than the five years previous. Rates topped 3% briefly a couple of times during 2018. markets.ft.com › data › bondsUS 10 year Treasury Bond, chart, prices - FT.com Aug 26, 2022 · Green bond rate increased to 3% Aug 26 2022; Don’t mess with ESG in Texas Aug 26 2022; India tipped to join pivotal JPMorgan bond index Aug 26 2022; Using the ‘Pottery Barn rule’ in the Treasury market Aug 26 2022; The carbon footprint fixation is getting out of hand Aug 25 2022; BlackRock labels Texas ‘anti-competitive’ over ESG ...

Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Resource Center | U.S. Department of the Treasury 26 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 52 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 1 Mo. 2 Mo. 3 Mo. 20 Yr. 30 Yr. Ultra 10-Year U.S. Treasury Note Futures Quotes - CME Group Ultra 10-Year Note Yield Curve Analytics ... a robust measure of 30-day implied volatility derived from deeply liquid options on Treasury futures. CME FedWatch. Explore probabilities for FOMC rate moves, compare target ranges or view historical rate data. Treasury Analytics. Analyze deliverable baskets, CTD/OTR securities, futures/cash yield ... Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

What Is a 10-Year Treasury Note and How Does It Work? The basics of a 10-year T-note involve paying the government a single lump sum at the beginning to purchase the bond — $1,000 apiece. The government then pays interest twice a year until the bond matures, at which point the entire sum you borrowed will be returned. The interest rate, known as the "yield," expresses the annual return on ... 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 3.11; Today's Change 0.000 / -0.01%; 1 Year change +130.50%; Data delayed at least 20 minutes, as of Aug 25 2022 15:00 BST. ... TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

ycharts.com › indicators › 5_year_treasury_rate5 Year Treasury Rate - YCharts Aug 18, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.20%, compared to 3.18% the previous market day and 0.80% last year.

10-Year T-Note Options Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

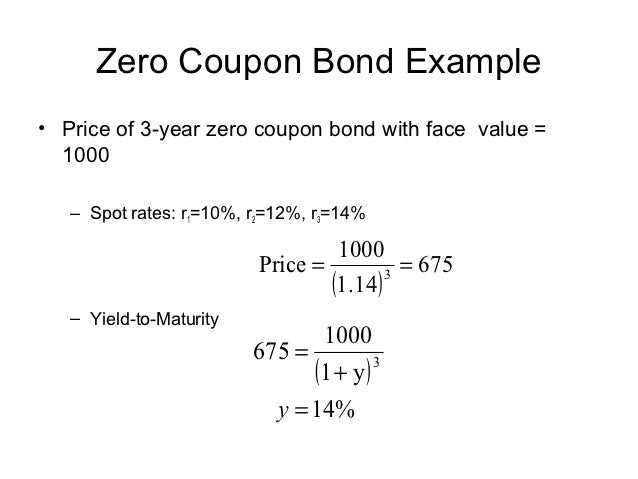

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Board of Governors of the Federal Reserve System (US), Fitted Yield on a 10 Year Zero Coupon Bond [THREEFY10], retrieved from FRED, Federal Reserve Bank of St. Louis; , August 23, 2022. RELEASE TABLES

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. Stock Screener. Stock Research. Market Indexes. Precious Metals. Energy. Commodities. Exchange Rates. Interest Rates. Economy. Global Metrics. 30 Year Treasury Rate - 39 Year Historical Chart. Interactive …

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.11% Yield Day High 3.113% Yield Day Low 3.095% Yield Prev Close 3.106% Price 97.00 Price Change +0.0312 Price Change % +0.0352% Price Prev Close 96.9688 Price Day High 97.0625 Price...

Post a Comment for "38 coupon rate 10 year treasury"