45 zero coupon bond value

How to Invest in Bonds: A Beginner's Guide to Buying Bonds For example, if you buy $10,000 worth of bonds at face value -- meaning you paid $10,000 -- then sell them for $11,000 when their market value increases, you can pocket the $1,000 difference. Bond ... en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.

Municipal Bonds Market Yields | FMSbonds.com The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 07/01/2022.

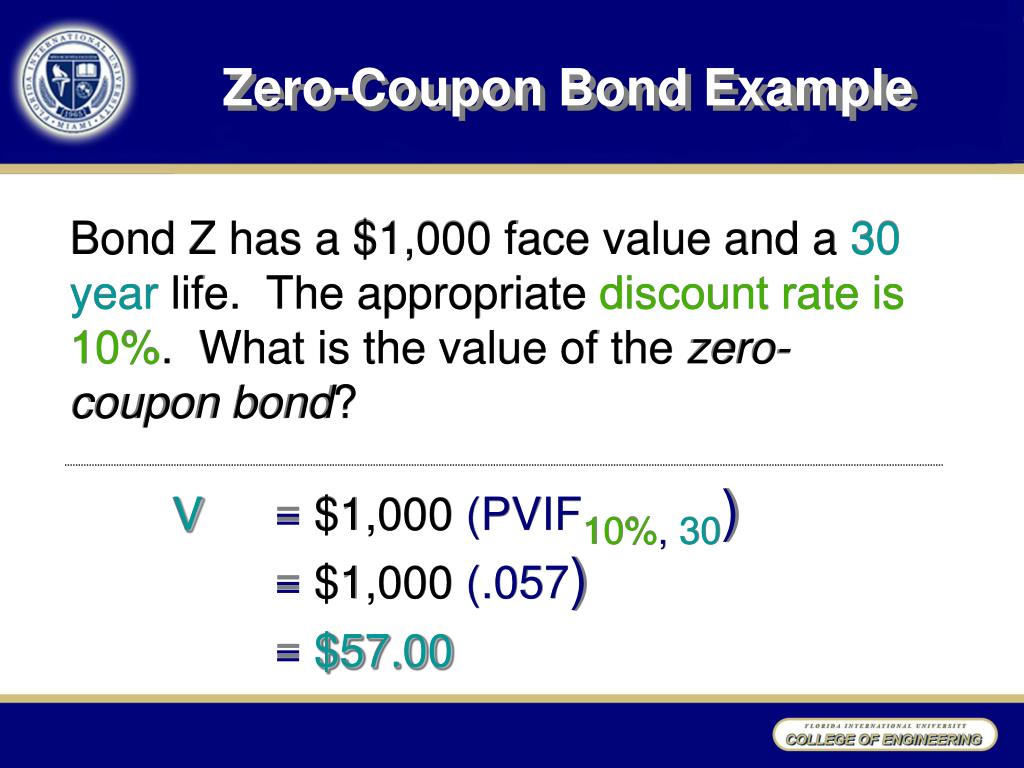

Zero coupon bond value

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond. The yield on the bond might be calculated on the basis of the ... Certificato del tesoro zero-coupon (CTZ) - Il Sole 24 Ore Segui l'andamento aggiornato dei Certificato del tesoro zero-coupon (CTZ). Rendimento, grafici interattivi, analisi e ultime notizie. Is Coke Zero Bad for You? - New Health Advisor The truth is that drinking Coke Zero regularly increases your risk of becoming obese. You may increase your waistline by 500% for drinking two or more cans a day. The reason is that artificial sweeteners present in Coke Zero affect your body's ability to regulate calorie intake. You are more likely to overeat if you consume diet foods more often.

Zero coupon bond value. Best Zero Turn Mowers 2022: Professional grade zero ... - Kirby Research 4. Ariens IKON XD Zero Turn Mower 915267 (52-Inch pick - Best 52-Inch Zero-Turn Lawn Mower) Ariens 915267 is among the flexible mowers with a user-friendly design. Because of the zero-turn capability, the mower stimulates you to control more obstacles such as trees and different textures nearby it. How to Calculate Face Value of a Bond in Excel (3 Easy Ways) For the first 2 methods, we will find the face value of a Coupon Bond and for the last method, we will find the face value of a Zero Coupon Bond. Moreover, we have these values given to us beforehand: Coupon Bond Price. Number of Year Until Maturity (t). The number of the Compounding Per Year (n). Yield to Maturity-YTM (r). Annual Coupon Rate. South Africa Government Bonds - Yields Curve Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; 50% Off Western Union Coupon, Promo Codes - July 2022 Get 25% Off Order At Westernunion.com Coupon: Limited Time: 25% OFF: Get 25% Off Money Transfer At Westernunion.com: Limited Time: 50% OFF: Enjoy 50% Off All Transfer Fees: Limited Time: DEAL: Send Money Online For $4.99: Limited Time: DEAL: Send Money For As Little As $1: Limited Time: Today's Top Western Union Coupons. Total Offers: 21:

› terms › bBond Definition - Investopedia Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Quant Bonds - Asset Swap Spread - BetterSolutions.com Asset swaps use zero coupon swap rate The zero-coupon curve is used in the asset swap valuation. Asset swap spreads represent the difference between swap rates and treasury bond yields. The asset swap spread is the spread that equates the difference between the present value of the bonds cash flows, calculated using the swap zero rates and the ... United Kingdom Government Bonds - Yields Curve Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; The 7 Best Stop Smoking Products for 2022 | Free Buyers Guide Nicoderm CQ. Cost: $49.99 for 14 patches (Step 1, 2 OR 3) NicoDerm CQ is nicotine patch equipped with Extended Release SmartControl Technology that helps to prevent the urge to smoke for up to 24 hours. The patch slowly releases nicotine throughout the day through your skin into your bloodstream.

Housing & Urban Development Corporation Limited NSE NCD Bonds, Price ... Close price will be updated after 18.15 hrs on account of joint press release dated February 09, 2018 (joint press release) On Ex-Date, the % change is calculated with respect to Adjusted price (adjustment with respect to Corporate Actions such as Dividend, Bonus, Rights & Face Value Split) 52 week high & 52 week low prices are adjusted for ... Types of bonds — AccountingTools Zero Coupon Bond. No interest is paid on a zero coupon bond. Instead, investors buy the bonds at large discounts to their face values in order to earn an effective interest rate. Zero Coupon Convertible Bond. A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. Credit default swap - Wikipedia A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to ... House price growth nearly at zero as property boom ends House price growth nearly at zero as property boom ends "Homes suffer slowest rise in value in 15 months" " House price growth has slowed to almost zero, marking an end to Britain's latest property boom ."

Eurodollar Futures Pricing and the Forward Rate Market - CME Group Assume that in December 2017, a June 2017 Eurodollar futures is priced at 99.10. This price reflects the market's perception that by the June 2017 expiration, three-month ICE LIBOR rates will be .90% (IMM Price convention= 100 - 99.10 = .90%). Eurodollars are really a forward-forward market and their prices are closely linked to the implied ...

Bonds Promo Codes | 10% Off In July 2022 | Lifehacker 20% Off. Expired. $10 off your birthday with the Bonds discount code. $10 Off. Expired. 10% off with the Bonds student discount code. 10% Off. Active. Bonds promo code for 40% off selected styles.

Obbligazioni Comit-98/28 Zc - Quotazioni - Teleborsa 0,703 Value at Risk; 4,794 Volatilità annuale; Info strumento---Cedola annuale; n.d. Frequenza cedola; ... Zero Coupon Tipo Bond; Intesa Sanpaolo Ente Emittente; 1m 3m 6m 1a Personalizza. Notizie ...

Accounting document number not generated and invoice raised with zero ... Please help me how we can stop the zero value invoices. Skip to Content. Home; Community; Ask a Question; Write a Blog Post; Login / Sign-up; Search Questions and Answers . 0. meghasham rajendra. Jun 24 at 05:10 PM Accounting document number not generated and invoice raised with zero value and zero quantity. 179 Views ...

How to Invest in U.S. Saving Bonds - The Motley Fool Series E bonds were sold at 75% of face value and would pay face value at maturity, typically after 10 years. The bonds, known as "war bonds," were considered zero coupon bonds and paid no annual ...

Post a Comment for "45 zero coupon bond value"